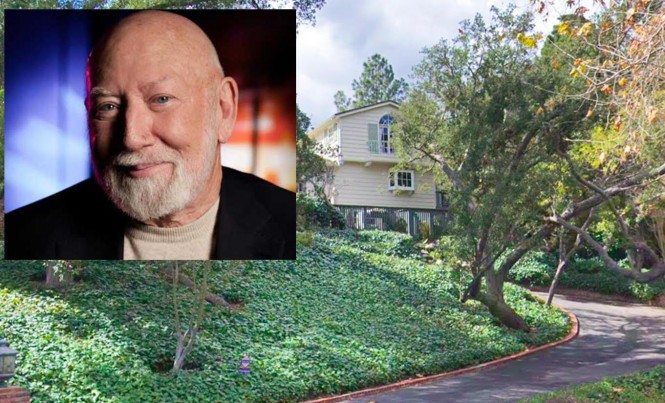

The co-creator of “Magnum P.I.” and “NCIS” sold his longtime home for $5.85 Million in an off-market deal

FROM www.MansionGlobal.com: Renowned television producer Donald P. Bellisario has sold his family’s longtime home in the Studio City neighborhood of Los Angeles, according to newly filed property records.

Mr. Bellisario, 83, owned the traditional-style house hidden behind a long drive and canopy of trees for more than 30 years. The creator of and writer for a slew of hit TV series in the U.S., including “Magnum P.I.,” “JAG” and “NCIS,” sold it in an off-market deal for $5.85 million, according to property records filed this month.

That’s a drop in the bucket for the Hollywood writer/producer, who continues to reap the benefits of having created some of the most successful evening detective series on television (“NCIS” was the fifth most-watched show during the 2017-18 season). Indeed, two years ago, Mr. Bellisario committed $30 million to his alma mater Penn State—one of the largest gifts ever given to the university.

Little is known about his longtime home in Studio City, since the hit-maker never listed it on the open market. Mr. Bellisario did not return a request for comment.But the latest details filed with the county show it was a four-bedroom, six-bathroom home built in the 1940s with over 5,200 square feet of interior space.

The home sits on a hill with spacious room for parking at the front of the house, and a large paved patio and freeform pool at the back, an aerial image of the home shows. Mr. Bellisario last renovated the home in the 1990s, according to records. This is the hit-maker’s second house sale in two years. He reportedly sold a grander, French Regency-style estate in Montecito in 2016 for $5.895 million.

WRITTEN BY BECKY STRUM FOR MANSION GLOABL

Original Article here: https://www.mansionglobal.com/articles/tv-series-creator-donald-p-bellisario-sells-l-a-house-for-5-85m-119628

Written by David Greene for FORBES: We all know some who frequently lament their decision to invest in real estate. Constantly blaming the market, or real estate as an industry, they believe the entire process is predicated on luck and timing, an exercise in chance. For people who have lost money investing, it’s easy to sympathize with them-but are their beliefs regarding results being beyond their control actually accurate?

Written by David Greene for FORBES: We all know some who frequently lament their decision to invest in real estate. Constantly blaming the market, or real estate as an industry, they believe the entire process is predicated on luck and timing, an exercise in chance. For people who have lost money investing, it’s easy to sympathize with them-but are their beliefs regarding results being beyond their control actually accurate?